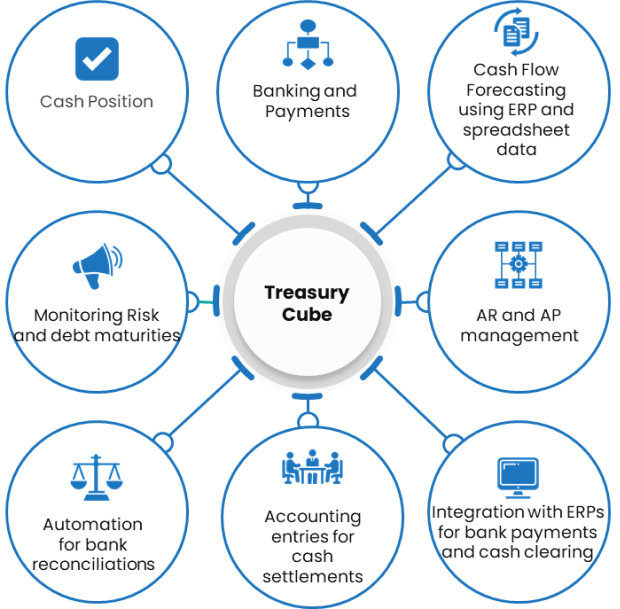

About TreasuryCube

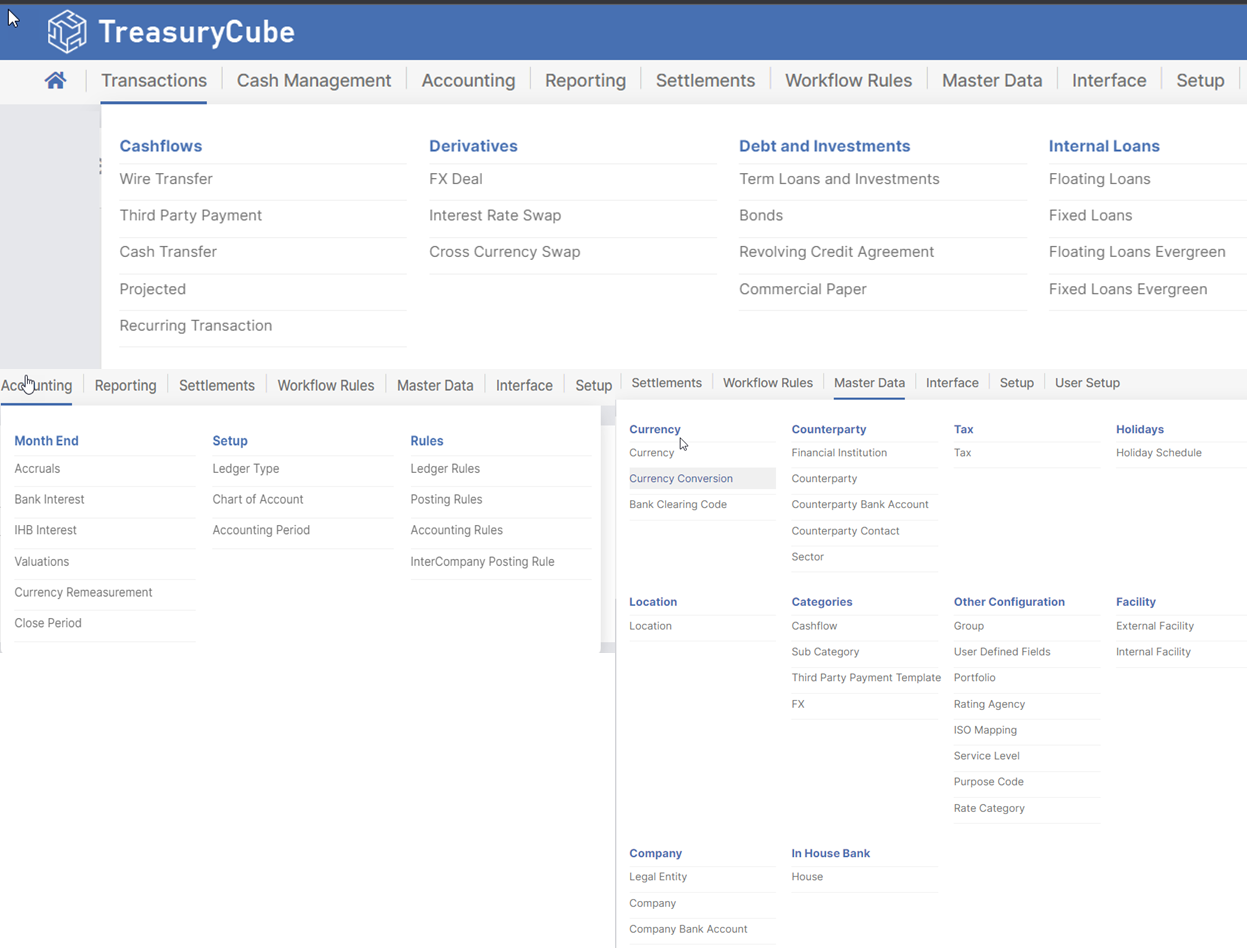

Treasury Cube™ is a comprehensive corporate treasury management software that helps companies manage their cash, liquidity, risk, and investments efficiently. Its robust features and user-friendly interface make it an essential tool for modern treasury departments.

Cash Flow Positioning & Forecasting

Treasury Cube™ enables companies to forecast their cash flows accurately by analyzing historical data and trends. This helps businesses make informed decisions on investments, funding, and liquidity management.

Investment Management

Treasury Cube’s investment management functionality allows companies to optimize their investment portfolios by identifying the best investment opportunities based on risk, return, and liquidity requirements. It also helps track and manage investments, ensuring compliance with corporate policies and regulatory requirements.

Debt Management

Treasury Cube™ assists companies in managing their debt efficiently by tracking outstanding loans, interest payments, and debt covenants. The software also enables organizations to analyze various debt scenarios and create repayment strategies, minimizing the cost of borrowing.

Reporting and Analytics

Treasury Cube™ provides comprehensive reporting and analytics capabilities, including customizable dashboards, automated report generation, and in-depth analysis of financial data. These tools enable companies to monitor their financial performance, identify trends and opportunities, and make data-driven decisions.

Compliance and Controls

The software ensures adherence to internal and external regulatory requirements, such as anti-money laundering (AML) and know-your-customer (KYC) guidelines. Treasury Cube™ also incorporates robust security measures to protect sensitive financial data and prevent unauthorized access.

Bank Relationship Management

Treasury Cube™ allows companies to manage their relationships with multiple banks efficiently. This includes maintaining a centralized repository of bank account information, tracking bank fees and charges, and negotiating better banking terms.

Straight-Through Processing (STP)

The software supports straight-through processing, enabling seamless integration with banks and other financial institutions. This automation reduces manual intervention, minimizing errors and increasing operational efficiency.

In-house Banking

Implement a payment hub within the in-house bank to go from manual payment processes to full automation for group companies maintaining cash sweep or consolidating bank accounts . Whether you aim to centralize or localize your payment processes, Treasury Cube™ will not only create accounting entries for inter company transactions but provide netting services as well without actual fund movement saving on transaction costs

Our Partners

Treasury Cube™ leverages the latest .NET 6 framework and web assembly technology to provide outstanding performance and security for all your treasury management demands.

Treasury Cube™ utilizes Palo Alto’s best in class firewalls and endpoint security

Request a Demo

Discover how Treasury Cube™ can transform your treasury operations. Request a demo today and take the first step towards smarter financial management.